Alipay gift card 支付宝购物卡 no service fee. Submit the completed.

Cryptocurrencies May Soon Attract 28 Gst Like Betting And Casinos In India A2z Taxcorp Llp

Loyalty programs and gift cards.

. - Jun 24 2022. Even presents you receive from the local authorities are also exempted from such taxes. Use in programming languages.

It was subject to tax. In order to access the headphones youll need to slide it down. 4500 RMB per day limit.

After making the first payment you may go to Purchased Items已购买的宝贝 to monitor your order status. Strings are typically stored at distinct memory addresses locations. As per the new rules the present given by the members of the family like parents spouses uncles aunts sisters and brothers is not subject to tax.

In most programming languages strings are a data type. This move is implemented in order to protect customer privacyRead More. History The Income Tax Act of 1922.

As the sales of gift cards is increasing every year your POS system must have the capability to manage those as well. There are a set of Nokia TWS earbuds hidden under the sliding cover of the Nokia 5710 XpressAudio. Thus the same string.

Originally if a gift was given and it was somewhat like shares jewelry property etc. The Rule the sequel to Pushpa. A nominee under conditional hibah gift.

Allu Arjun Rashmika Mandanna. HSN Code List for GST in pdf HSC Codes in Excel Format Find HSN Code for Your Business. The shooting for Pushpa.

AND SAC stands for Service Accounting Codes which are adopted by. As per the new rule online merchants will not be able to store the customers credit card or debit card details in their system. Service fee is 15.

Support us in building the People Power of Southeast Asia by participating in our movement. As you have learned in the. Effective July 1 RBI would be implementing the tokenisation rule for debit and credit cards.

New Naratif empowers Southeast Asians by giving them the information and tools to be fully engaged and participatory citizens. Instead of using traditional punch cards you can now track your customer loyalty incentives using the POS system. Todays POS system go beyond processing sales.

The latest reports suggest that the star cast of the film has hiked their remuneration. You can get the form here. The Income Tax Act of 1922 was prevalent during the British Raj and was inherited by both the governments of India and Pakistan upon independence and partition in 1947.

Australians can buy it from local post offices. Guidelines for determining nonprobabilistic sample sizes are virtually nonexistent. If you want to do a nomination after you have purchased your certificate you must submit the completed nomination form to us.

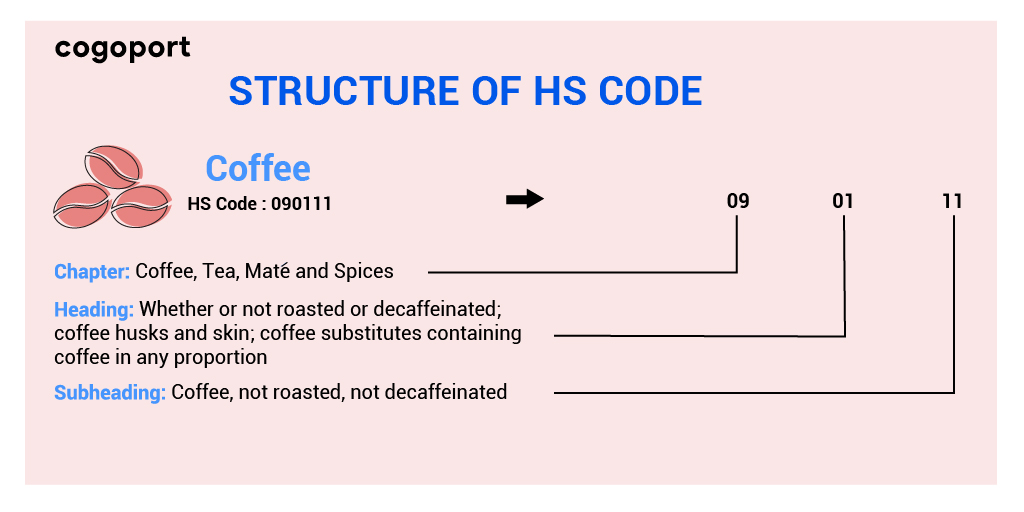

Check out our HSN Code finder HSN stands for Harmonized System of Nomenclature which is an internationally accepted product coding system used to maintain uniformity in the classification of goods. The Rise has begun. In context-free grammars a production rule that allows a symbol to produce the empty string is known as an ε-production and the symbol is said to be nullable.

If somebody other than that of the. Purposive samples are the most commonly used form of nonprobabilistic sampling and their size typically relies on the concept of saturation or the point at which no new information or themes are observed in the data. You must fill up the nomination form during certificate application or you can do so after you have purchased the certificate.

Tax Implications On Money Transferred From Abroad To India Extravelmoney

Hs Code All About Classification Of Goods In Export Import

The Unfortunate Consequences Of Gst Anti Profiteering Rules Mint

No Input Tax Credit For Gst Paid On Expenses Incurred On Promotional Schemes Rules Aar A2z Taxcorp Llp

Amazon Seo How To Get Your Products Found

What S New In The World Of Gst Tax Alert February 2021 Deloitte New Zealand

Overview Impact Challenges Roadmap Ppt Download

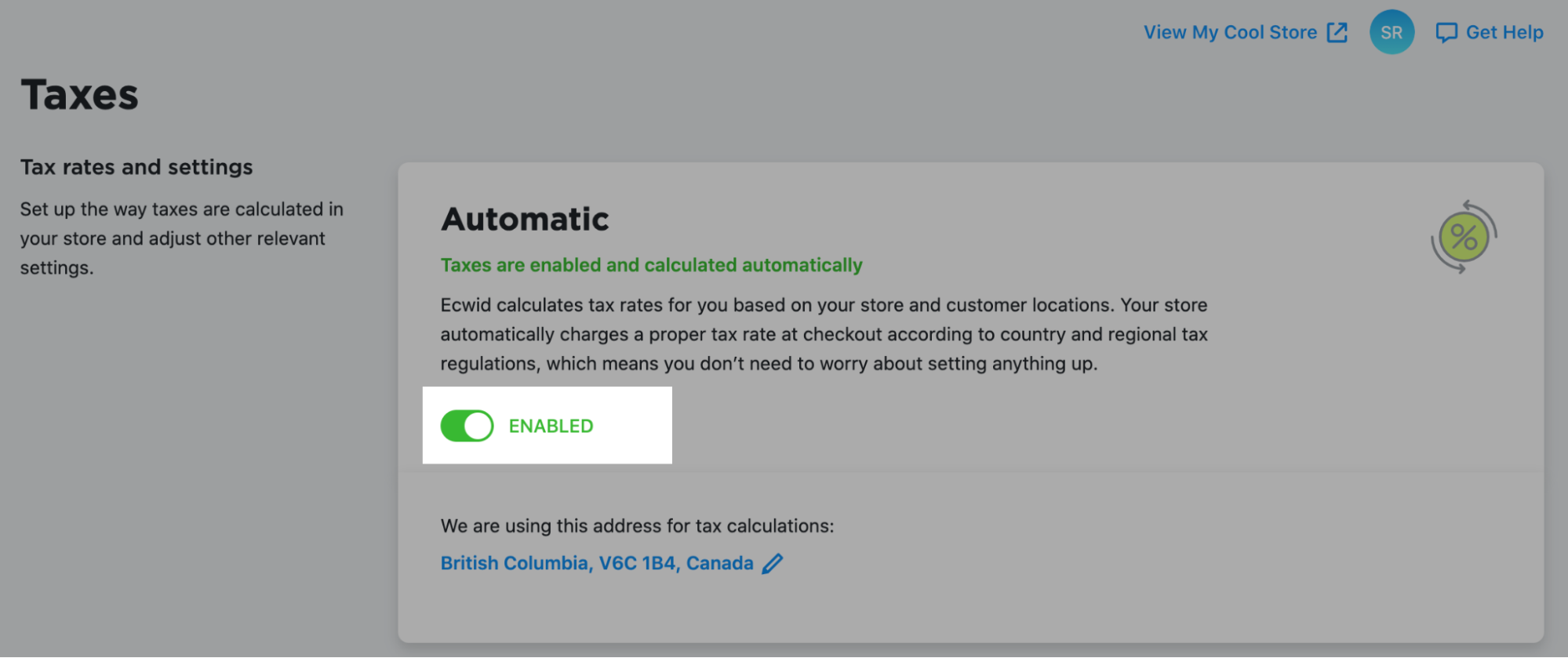

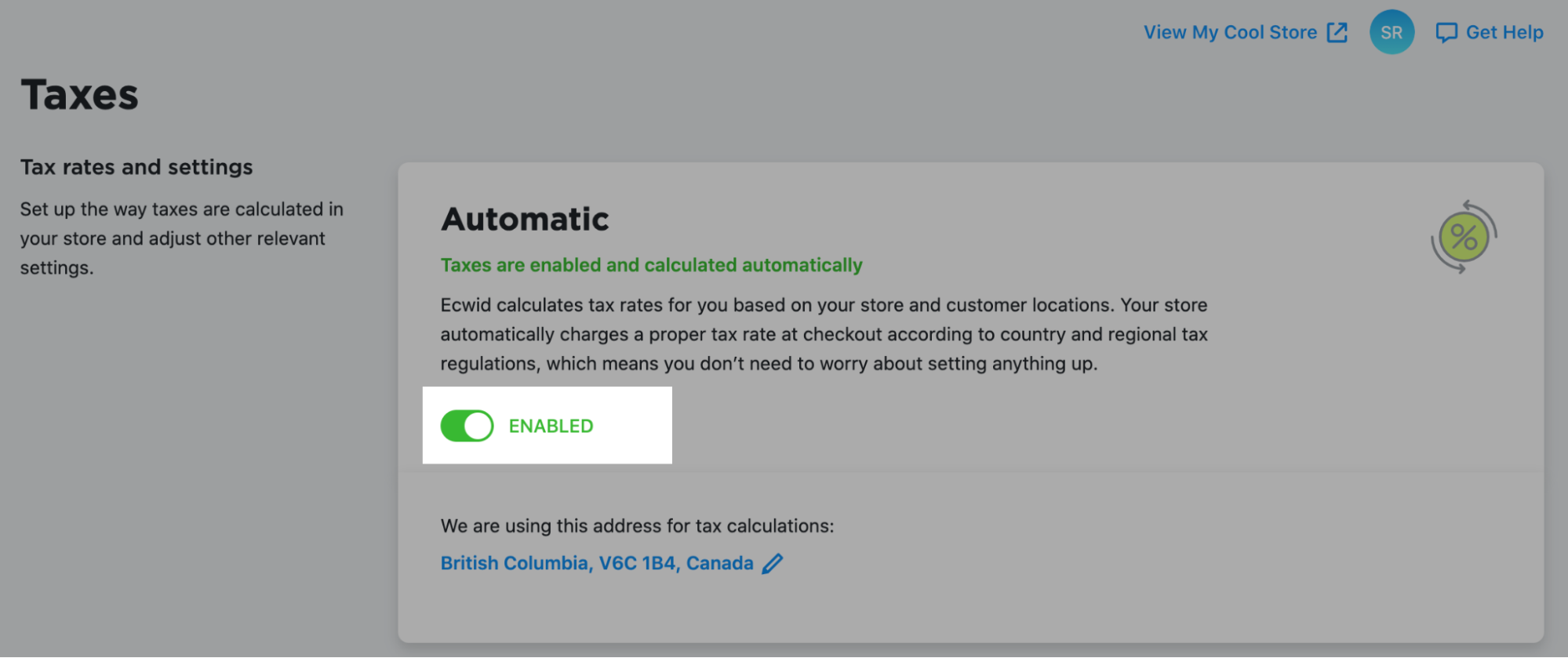

Canada Taxes Gst Pst Hst In Ecwid Ecwid Help Center

Input Tax Credit Under Gst How To Claim Calculation Method

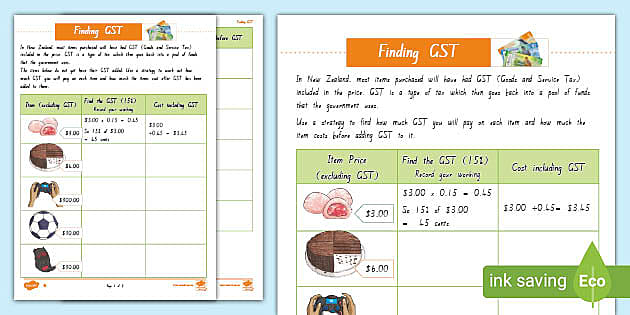

Calculating Gst Resource Pack Year 6 Financial Mathematics

Gst Export Bond Format Lettering Bond Sample Resume

Shipping To Canada Customs Carrier And Import Fees Explained

Hs Code All About Classification Of Goods In Export Import

Good And Service Tax Gst Linkedin

Ag Report On Taxation Describes A Porous Canadian Sales Tax Regime Tax Authorities Canada

Hs Code All About Classification Of Goods In Export Import